Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market.

The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers.

This compensation comes from two main sources.

#Single tax brackets 2021 for free#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. Credits provide a dollar-for-dollar reduction in the amount of taxes you owe.ĭepending on your financial situation, you can use both tax deductions and credits to lower the amount you pay Uncle Sam each year. Tax credits, such as the earned income tax credit or child tax credit, also can put you into a lower tax bracket. Deductions help cut your taxes by reducing your taxable income. You can lower your income into another tax bracket by using tax deductions, such as the write-offs for charitable donations, property taxes and mortgage interest.

#Single tax brackets 2021 how to#

How To Calculate Your Federal Income Tax Bracket

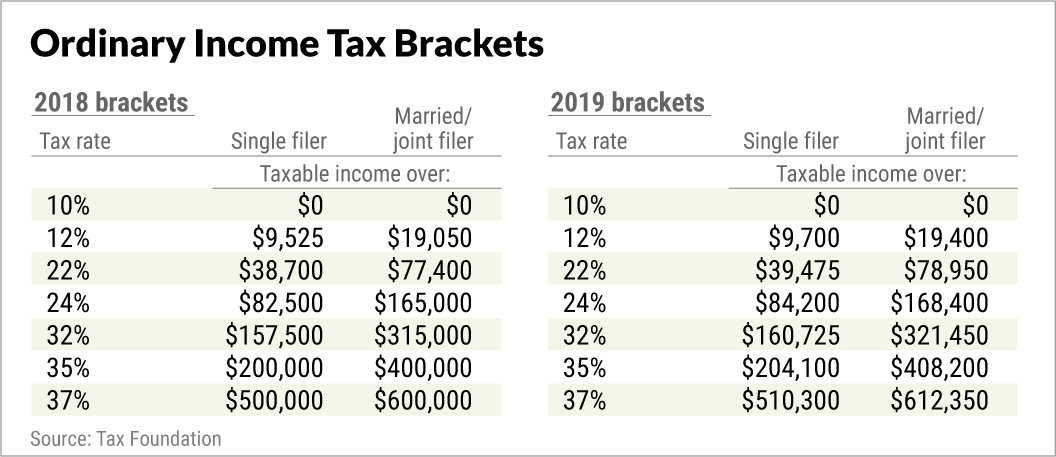

Here are some reasons why you should file. You may be entitled to money from the IRS even if you have little to no income. Trending Story: File A Tax Return This Year, Even If You Usually Don’t Do It Some of that will be taxed in lower brackets. For example, if you’re single and your 2022 taxable income was $50,000, not all of that will be taxed at 22%, the top bracket for a single person making $50,000. If your taxable income increases, the taxes you pay will increase.īut figuring out your tax obligation isn’t as easy as comparing your salary to the brackets shown above. The amount you pay in taxes is dependent on your income. The brackets help determine how much money you need to pay the IRS annually. Tax brackets were created by the IRS to implement America’s “progressive” tax system, which taxes higher levels of income at the progressively higher rates we mentioned earlier. 2023 Married Filing Jointly Tax Brackets If taxable income is:

0 kommentar(er)

0 kommentar(er)